Answer these simple questions and we will find you the BEST prices

Which type of solar quotes do you need?

It only takes 30 seconds

100% free with no obligation

Tell us what you need to find a matching specialist

Get free quotes from professionals near you

Compare offers and choose the one that best matches your need

- whatcost.co.uk

- Stairlifts

- Stairlift Insurance

Stairlift Insurance: Costs, Possibilities & Recommendations

- Stairlift insurance protects against theft, unintentional damage, and mechanical failures by covering repairs, replacements, and occasionally maintenance..

- Basic policies can range from £40 to £150 and £150 to over £500 for comprehensive coverage.

- Stairlift insurance is needed if you rely heavily on your stairlift, have an expensive stairlift model, or want to prevent incurring unexpected costs, especially after the manufacturer's warranty expires.

Stairlift insurance aims to protect you against unexpected damage that could cost you expensive repairs or replacements. It also gives you financial security against unforeseen expenses related to theft, damage, or stairlift repairs.

Let’s imagine that you’re an elderly individual who heavily relies on the stairlift for daily mobility. One morning, you accidentally bump your walking stick into the stairlift control panel causing it to malfunction. In this scenario, stairlift insurance can help you immensely by covering your replacements and costs.

Policies can range greatly, from basic plans that cover necessary repairs to extensive alternatives that include emergency call-outs and routine maintenance checks. Stairlift insurance is not compulsory on your purchase. It can provide peace of mind if you depend on your stairlift for regular use. When you purchase an older stairlift with expired warranty, stairlift insurance is helpful to ensure you have continuous mobility and independence.

Keep your peace of mind and your investment safe! Are you concerned about insurance for stairlifts? Don't make this choice by yourself. In addition to helping you locate the ideal mobility solution, our knowledgeable stairlift consultants can also walk you through your options for insurance.

We'll match you with up to 4 local stairlift professionals who can offer free, no-obligation quotations on any type of stairlift by using our short 30-second form. Seek expert guidance on possible expenses, whether insurance is appropriate for you, and the best ways to protect your freedom.

Click the button below to start saving your time and money.

- Describe your needs

- Get free quotes

- Choose the best offer

It only takes 30 seconds

How does stairlift insurance work and what does it cover?

The purpose of stairlift insurance is to protect its users against unforeseen costs related to repairing, maintaining and replacement of their stairlift. It helps the consumer be at peace by making sure that your stairlift functions without costing you any out-of-pocket expenses.

Here is how stairlift insurance works:

Just like any other insurance, after you purchase a stairlift insurance policy, you are liable to pay a monthly or an annual insurance premium based on the stairlift you own and the coverage level you choose.

If you face an issue with your stairlift that is covered under the premium, you can go on to submit a claim to have the problem fixed. You can do this without having to pay out of your pocket for the repair or replacements. These insurance policies often give access to qualified specialists for repairs. This helps your stairlift be back in operating condition as soon as possible.

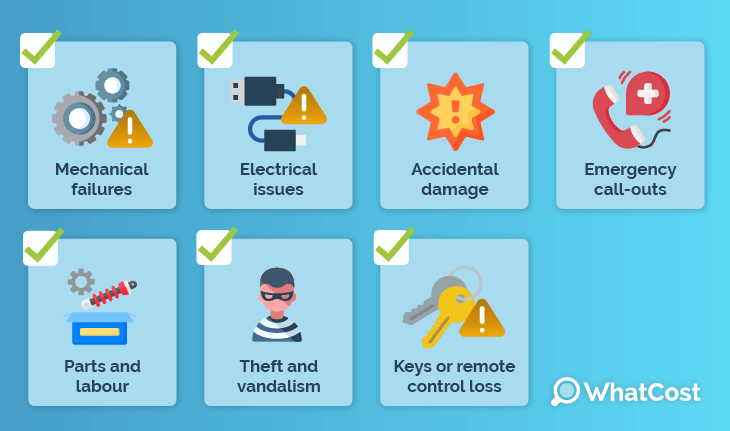

Now let’s check what the basic stairlift insurance policy covers:

Stairlift insurance policies vary according to what you choose, but they typically include coverage for:

- Mechanical failures: It will cover repairs for issues caused by the wear and tear of the stairlift or malfunctions in the motor, track, or other parts.

- Electrical issues: It protects against motor failures or wiring faults which constrict the stairlift’s proper operation.

- Accidental damage: Protection against harm caused by unforeseen circumstances, such as putting heavy objects on the stairlift.

- Emergency call-outs: In the event of unexpected malfunctions, it reduces downtime and inconvenience by providing quick assistance.

- Parts and labour: The price of technician services and replacement parts is needed to resolve any mechanical and technical issues.

- Theft and vandalism: Although it is uncommon, some policies for outdoor stairlifts may cover vandalism such as tampering with controls or tracks, theft of parts (e.g., batteries) etc.

- Keys or remote control loss: The replacement price for misplaced or broken keys or remotes that are used to operate the stairlift.

For further safety, some policies could also offer you optional add-on services like yearly maintenance or extended warranties. Usually, policies do not cover standard wear and tear. This can include things such as degraded upholstery, minor dents, or scratches. Hence, you should always read the policy conditions carefully before purchasing your stairlift.

Knowing how stairlift insurance works and what your policy covers can help you make well-informed choices about protecting your mobility assistance and guaranteeing continuous and uninterrupted use.

How much does stairlift insurance cost?

The average cost of stairlift insurance in the UK ranges from £100 to £300 per year. This depends on several criteria, including the type of coverage, the complexity and the cost of stairlift, and the insurance provider. You will be able to make an informed decision about protecting your mobility investment when you understand these costs.

Annual costs

The average annual cost for stairlift insurance in the UK often falls within the following ranges:

- Basic insurance policies: £40 to £150 per year

- Comprehensive insurance policies: £150 to £500+ per year

Most consumers looking for stairlift insurance can expect to pay anywhere between £100 and £300 yearly.

Factors affecting cost

Several factors can influence the price of your stairlift insurance. Here are these factors you should consider:

- Value and type of stairlift (straight, curved, or perched)

- Age and condition of the stairlift

- Extent of coverage (e.g., accidental damage, theft, mechanical breakdowns)

- The location of your home

- Frequency of stairlift use

Lifetime costs

When you consider lifetime costs, it's important to factor in the following:

- Initial purchase price of the stairlift (£1,500 to £5,500 on average)

- Annual insurance premiums

- Potential out-of-pocket expenses for deductibles or uncovered repairs

On average, you can expect to spend anywhere between £1,000 and £5,000 on stairlift insurance over a 10-year period. This depends on the level of coverage you choose.

Do you always need to pay for stairlift insurance?

Stairlift insurance is not provided when you purchase a new stairlift. It is often purchased separately through a third-party company. It covers accidental damages, stolen stairlifts and vandalism and can provide buyers with peace of mind for a longer period of time.

While it is not legally required to purchase, it is often advised to the customers as it can be helpful. However, there are several situations where you may not need to pay for separate stairlift insurance:

- Manufacturer's warranty: Most stairlifts come with a 2-year basic warranty that will cover manufacturer defects and parts. You may not require an additional insurance during this time as the provided warranty acts as the assurance from the manufacturer that the stairlift would not need to be replaced.

- Building insurance: Stairlifts are considered fixtures and fittings and your building insurance may provide you coverage.This usually covers you from accidental damage, fire, theft, vandalism etc. But double-check to see if your policy specifies that stairlifts are explicitly included in it.

- Extended warranties: Stairlift providers might be able to help you get extended warranties for 1-5 more years after your purchase. This is a great option for people who rely heavily on their stairlifts and want the same company to help with unexpected costs and repairs.

- Self-insurance: If you are confident to cover the potential stairlift repair or replacement costs out of your own pocket, then you could choose to skip stairlift insurance.

It is essential to carefully consider the costs you will incur out-of-pocket for repairing your stairlifts to the collective costs of insurance premiums. Getting a stairlift insurance can give you peace of mind and financial protection especially when you have invested in an expensive model or rely heavily on the stairlift for your mobility.

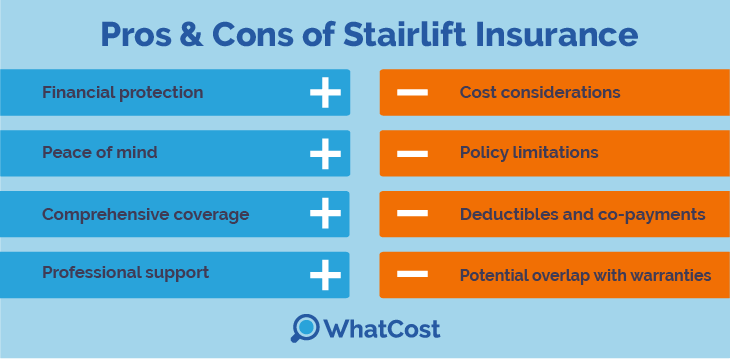

Advantages & disadvantages of stairlift insurance

Both the advantages and disadvantages of stairlift insurance should be looked into carefully before you decide on investing in a policy. Understanding these benefits and drawbacks can help you make a smart decision. Let’s look at the pros and cons of stairlift insurance.

Financial protection

Stairlift insurance has several policies in the UK ranging from £40 to over £500 annually, which provides a safety net for buyers against potential significant out-of-pocket expenses for your stairlift.

Peace of mind

When you have insured your stairlift, it can help reduce stress and anxiety about potential damages or breakdowns you might face. This is especially important for those who heavily rely daily on their stairlift for mobility.

Comprehensive coverage

With many policies offering wide-ranging protection, it ensures that most potential issues are taken care of. These policies may offer coverage for mechanical failures, electrical issues, and accidental damage to your stairlift.

Professional support

Your stairlift should be looked at by a qualified technician when it requires repairs and maintenance. Stairlift insurance usually includes free and easy access to these professionals.

Cost considerations

Yearly premiums for your stairlift insurance can be quite hefty, especially if you plan to look into any of the comprehensive policies. These policies can usually go above £500 per year. Hence, it is important to compare this expense against the potential benefits it may give you.

Policy limitations

All of the damages might not be included in your standard policy with exclusions like

pre-existing conditions, replacing batteries, or certain types of mechanical failures with your stairlift. It is important to go through the review policy details clearly so that you are aware of what is not covered.

Deductibles and co-payments

Deductibles and co-payments are additional costs for repairs or replacements that some insurance policies require you to pay. This can still result in expenses straight out of your pocket, even when you have insurance coverage.

Potential overlap with warranties

When you think of insuring a new stairlift, it might overlap with the warranties that manufacturer already provides. This makes it an unnecessary expense in the early years of owning the stairlift. While it can be beneficial to insure your reconditioned stairlifts because of high chances of wear and tear, you should also note that the premiums for these would be higher than the newer models.

When you decide whether a stairlift insurance policy is good for you, carefully consider these pros and cons. You should also look into factors such as the condition of the stairlift, the cost of repairs, how old your stairlift is and this will help you figure out if stairlift insurance is a smart move for you.

Is insuring your stairlift a good idea?

It is not compulsory to insure your stairlift, but it is advised as it can help you with extra protection and peace of mind. It completely depends on everyone’s personal situation if you would need stairlift insurance.

- You use it daily for your mobility

- You own an older or out-of-warranty stairlift model

- You have accidental damage costs that will strain your pocket

- You want an elaborative policy that offers a wide range of protection

- You have a new stairlift, and it is under the manufacturer’s warranty

- You have house insurance that provides sufficient coverage

- You are okay to cover all the potential repair costs out of your pocket

For many users who are dependent on their stairlift daily, the protection and ease of stairlift insurance outweigh the costs. You should always compare these policy costs against the potential damage costs you would pay.

Our trusted stairlift installers are not only experts in mobility solutions, but they also help you decide whether stairlift insurance is worth it for you. Fortunately, with our service, finding a reliable professional and comparing quotes couldn’t be easier.

Just fill out our quick 30-second form, and we'll connect you with up to 4 local stairlift installers in the area. They'll provide you with free, no-obligation quotes for stairlift installation and share their knowledge about insurance options. Click now to take the first step towards a safer, more mobile future – expert advice on both your stairlift and insurance needs is just a click away!

- Describe your needs

- Get free quotes

- Choose the best offer

It only takes 30 seconds

FAQ

Stairlift insurance typically costs between £40 to £150 annually for basic policies and £150 to £500 for comprehensive coverage. The exact price of the policy depends on factors like the stairlift’s value, age, type, and coverage level.

Yes, stairlift insurance is worth considering if you rely heavily on your stairlift, have an older model, or want protection against unexpected repair costs. It provides peace of mind by covering potential mechanical failures, accidental damage, and emergency call-outs, which can be financially significant.

Home insurance may partially cover stairlifts, but coverage varies. Most standard home insurance policies include stairlifts as fixtures and fittings, potentially protecting against fire, theft, and accidental damage. However, mechanical breakdowns and wear-and-tear are typically not covered.

Swathi’s journey in the field of content creation began with her education in journalism, where she developed a deep understanding of the power of words and the importance of effective communication.